Day trading for pain and suffering

I ran a 6 month experiment in day trading between June and December 2020. I wanted the title of this article to be “Day trading for fun and profit” but that couldn’t be further from reality and would be straight up lying. 🥲

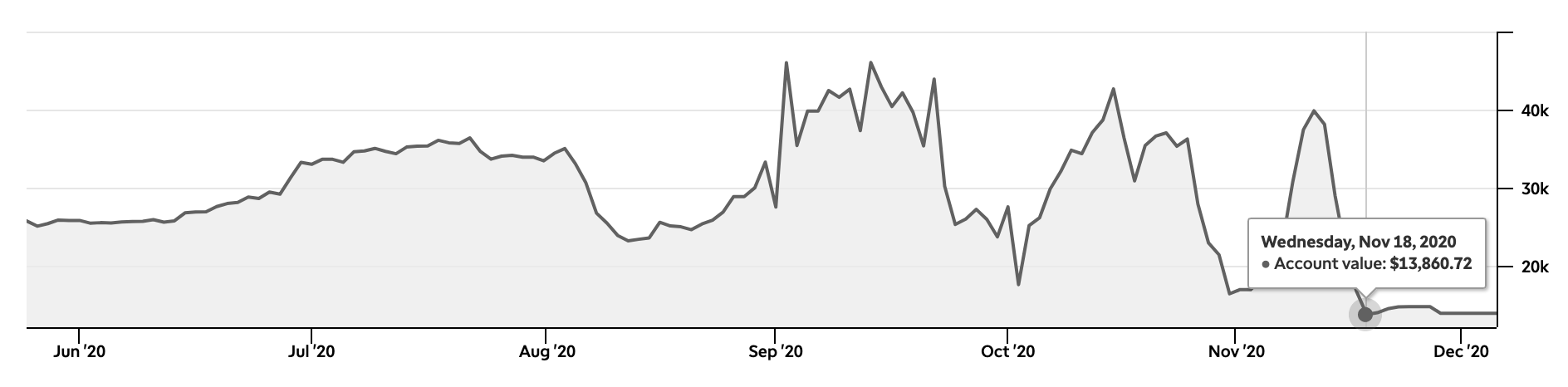

Saying it was “brutal” would be an understatement. The rollercoaster of emotions can be illustrated by my trading account balance chart below during that period.

I almost blew up my account not only once, not twice, but three times, as you can see above in October, November and December.

On November 11th, 2020 I had ~$40k on my account. On November 18th, a mere week later, I had just $13k, an astonishing 68% loss in 7 days. I was mentally and physically exhausted and, at that point, I knew I could no longer keep doing it.

1. The excitement

Living on the west coast, I convinced myself to wake up at 6am every weekday morning, something that I’ve probably never done consistently in my entire life. I wanted to prepare before the market opened at 6:30am PT (9:30am ET) to start trading. Since most of the price action happened in the first hour after market open, it was important for me to be up and ready in front of the computer at that time, so I could capture any opportunities as soon as they presented themselves.

I’ve been attracted to finance and trading since I was a teenager, but never really had the money, time or the focus to actively trade. It was something I’ve always wanted to try though, so I was up to the challenge this time.

Inside myself I knew that, if only I put enough time and energy into this, I could learn and master it like any other skill. I was wrong.

2. The fallout

I was not prepared to deal with the emotions that arise from seeing weeks or months’ worth of profits disappear from my account in a matter of minutes. It’s really difficult to put in words the number of feelings that went through my mind during that period, but some of them are excitement, euphoria, greed, sadness, shame, anger, despair. One day you feel invincible. The next day you feel like shit 💩.

I don’t really remember where I read this, but one learning that really stuck with me was that “Day trading feels like a mirror pointing at you, revealing all your weaknesses, right in your face”. This couldn’t be more true.

Trading is great at revealing all your shortcomings, your greed, impulsiveness and lack of discipline are completely uncovered when you struggle with following a simple trading plan.

No amount of staring at charts, signals or technical analysis was enough to stop myself from making the same mistakes over and over again. Letting emotions take over and affect my decision making. I was not ready for it.

It was hard to admit, but at that point it was clear that I couldn’t go on with it. This new routine was starting to negatively impact my mood, relationships and focus at work. I was often tired and distracted by those thoughts and feelings running in the back of my mind.

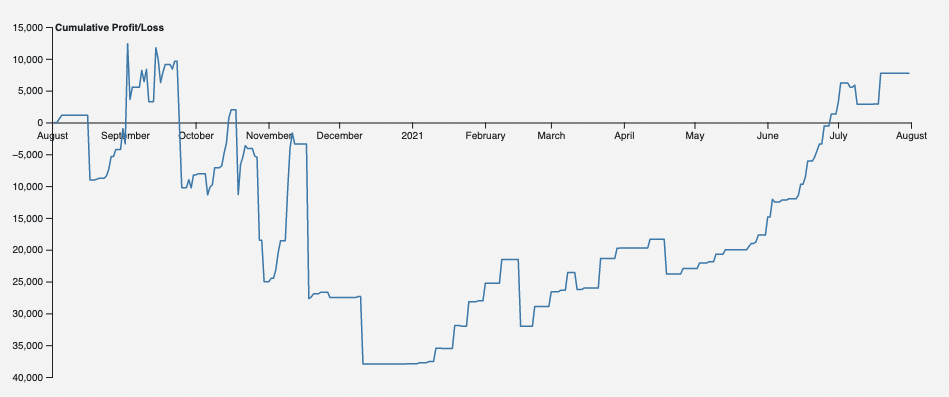

In December I decided it was time to take a break and reevaluate. I was looking at almost $40k in accumulated loss. It was hard to accept defeat, but it was the right thing to do.

3. A new beginning

About a year ago, while chatting with a friend about trading he mentioned this thing called “Theta Gang”. I tried it at first but didn’t really stick to it. Theta Gang, or “The Wheel”, focuses on option selling instead of buying and waiting for them to either expire worthless or get assigned. You do this every week, collect your premium and move on with your life. Next week, you rinse and repeat. As long as you play the wheel only on stocks that you don’t mind holding (in case it gets assigned), it’s a great way to generate passive income with low chances of losses but also but a limited upside. I think the capped upside made it less attractive to me at first, so I dismissed it quickly, however I now see this as a great system to generate trading income with low stress and low time commitment, as opposed to day trading as I was operating before. I don’t have to wake up at 6am anymore or stare at charts for hours a day. I also don’t stress out about every tiny price movement and can have a more balanced and healthy life as a result.

Since then, I’ve recouped all my losses and then some. You can see above a clear steady uptrend in my cumulative P/L since the beginning of 2021. This is a result of changing my system. Sure, I won’t score a massive 5,000% win in a single trade but also I will no longer wipe out months of profits in a single day. This has been working great for me since then and I’m very thankful to my friend @jpemberthy for getting me into the “gang”. 🙂

4. What’s next

Part of improving my trading system was also having better tools to track and analyze my progress. As the saying goes “what gets measured gets managed”. I found that the tools that TD Ameritrade (my current broker) offered were very limited and not enough for me to understand how well or poorly I was doing. That’s why I started building stocks.dog.

For stocks.dog I built an integration with the TD Ameritrade API so that a user’s trading history can be fetched and analyzed. Authentication is done via OAuth, so we never see or store the user’s password. This allowed me to build custom tables, charts and dashboards which were not possible before. There’s a lot more that I’m planning to build in order to make it more useful for other theta gang traders like me. If you’re a trader and would like to try it out, please reach out to me via Twitter or email. I’d love to get feedback on what I’ve been building.

It turns out that finding users and a distribution channel has been quite challenging for me, though. I’m still learning how to best approach that problem and will be sharing my learnings, in a true “build in public” fashion. 🤘